How to get the most value from your D&O premium dollars and reduce D&O Insurance costs. The huge premium increases we experienced in private company D&O insurance seem like a distant memory now. The disruption that began in late 2018 continued for most private companies purchasing directors’ and officers’ liability insurance through most of 2021.

Since then, the D&O marketplace saw new insurers to market, fresh capital entered the market, and pricing became more competitive.

That change in pricing trends did not occur across all market segments or sectors. In fact, there are several sectors where pricing is firm and terms are more difficult than in the general private company marketplace. Those would include firms in life sciences, cannabis, fintech, and other unique startups.

How much has the pricing of private company D&O insurance changed?

We saw substantial cost decreases in 2022 renewals, but during our 2023 renewals pricing has been fairly flat with some slight reductions.

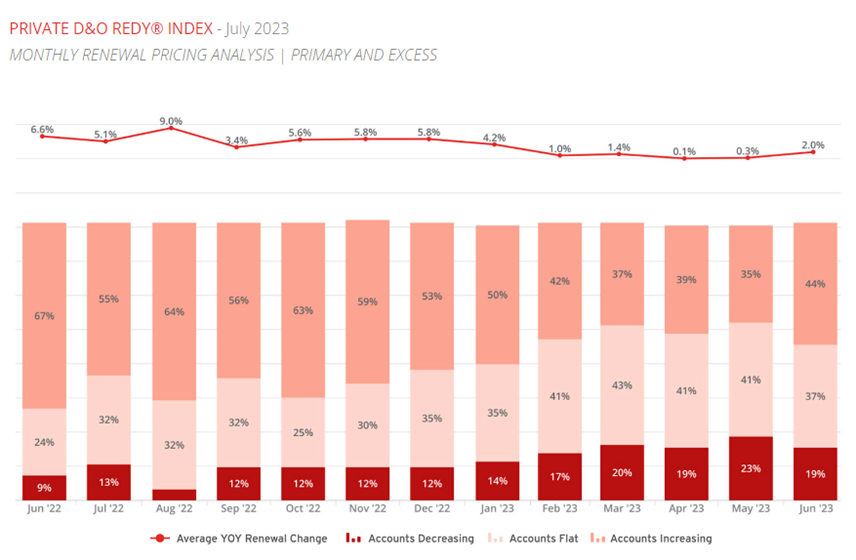

Insurance wholesaler CRC publishes some interesting statistics drawn across their large book of business, and in the chart below you’ll see the past 12 months of insurance pricing trends across experience. It’s not entirely clear what pricing is doing here because D&O insurance pricing is dynamically driven by each insured’s characteristics, which are shown below.

As an example, a company that grew top-line revenue by 12% and added new employees to payroll may have experienced a D&O premium increase, which is logical based on the company’s new rating factors. But if that increase was just 3% it probably should be characterized as a premium reduction, but it’s impossible to correlate that into a chart like this.

Use this link to this chart: https://www.crcgroup.com/Tools-Intel/post/private-d-o-redy-index-july-2023

I can tell you that in my experience we have seen prices moderate tremendously over the past two years and have negotiated rate decreases for clients that saw significant growth.

In order to address tips or ideas on how to reduce your company’s D&O insurance costs, let’s first look at the key drivers that underwriters use to determine the insurance premiums you pay:

What affects D&O insurance costs?

Company size in terms of revenue and assets

Employee headcount

Financial conditions as reflected in company financial statements

Industry sector

Claim history

Management experience and tenure

Insurance market trends

From this list, you can probably surmise that there’s not a lot you can do to any of these factors, these are baked into your firm’s operation. Your financial statements are what they are – sure you always are working towards improving them, but the snapshot they offer cannot be altered just for your D&O renewal.

The same is true for the number of employees you employ, and your management experience level.

So, how do you find opportunities to reduce your D&O insurance costs on your next renewal?

I think the answer to that is really found in the way you and more specifically, your insurance broker, approach the renewal of your D&O Policy.

Now, I think it’s important to clarify my audience. My focus in this discussion is lower middle market and smaller firms, and startups.

I am not speaking to public companies or larger mid-market firms served by the top 10 international brokers. This distinction is important because I think small and medium-sized business owners are underserved by the majority of insurance brokers out there.

Part of this is due to the fact that most retail insurance brokers are not specialists in D&O and related lines of insurance. They do it here or there as clients need it, but it’s not a focus point in their agencies or books of business.

These brokers may be good at general insurance – property, liability, workers comp, etc. but their level of expertise and market access for management and professional liability insurance is likely limited, and this results in clients not getting the best results.

Here’s what we see very often in this market from local brokers who don’t really “get” D&O insurance.

They start the renewal process too late.

They engage one underwriter from one of their big insurance companies where most of the other lines of business are placed for the client.

They take what they get and don’t explore options strategically.

There are usually no client discussions on increasing limits, adding dedicated A-side protection, changing retentions, or enhancing protection.

At the end of the day, you, the client get the renewal at the last minute, with little explanation as to insurance cost or what was done to maximize your results.

That’s unfortunate because it means you may be at risk of missing out on opportunities to reduce your costs, broaden your protection, or level up the scope of coverage.

So, if the pricing for most D&O renewals is going down how do you maximize this opportunity?

Good question.

Start Early

I think the first step is to start your renewal process early – like four months before your current insurance policy renews. Have a discussion with your broker, if they don’t engage first, and start asking what they think the state of the market is and what they will do to take advantage of this unique opportunity.

I’d also be researching the scope of your current protection.

Are your limits in line with your peer group?

Do you purchase employment practice liability insurance or EPLI?

How about Fiduciary Liability insurance? (Both Fiduciary and EPLI can be added to a private company D&O Policy)

If you do have those three forms of insurance, D&O, EPLI, and Fiduciary on the same policy, are your limits sufficient to protect you from exorbitant claim costs?

Have you examined your retention or explored what a higher retention would do to your premiums?

Have you explored dedicated A-side protection?

Do you understand the terms, conditions, and exclusions in your current protection?

The other question I’d ask your broker is:

“What other insurers will you be bringing our account out to on this renewal”?

If you’re paying over $15,000 a year on D&O insurance, it probably makes sense to see some alternative quotes on your renewal every few years. I don’t recommend doing this on every renewal, but every three years should be sufficient and with consideration to market conditions.

Finally, if you’ve experienced difficult D&O renewals, or are paying over $25,000 a year for D&O coverage, or you’re in a “targeted” industry that has not seen pricing relief in this down cycle, then it might make sense to have an underwriting call.

What is an underwriting call?

An underwriting call is arranged and hosted by your insurance broker and includes the underwriters who have expressed an interest in quoting your management liability coverage. This call can be conducted with all interested underwriters at the same time, or individually. This gives each underwriter the opportunity to ask you questions that don’t appear on a renewal application.

There may be certain concerns around your financial statements a particular lawsuit, or some other element of underwriting, on their minds which are influencing their ability to offer a quote or not, or what price they’re willing to extend.

I have found these calls invaluable.

Often there is a misunderstanding or misread of a situation that is clarified during a call which leads to more underwriters being willing to offer quotes.

Underwriters also get a more “human connection” from these calls and there’s more of a willingness to work with someone once that connection is made.

Then, when those quotes are in, it’s the job of your broker to negotiate and work the responding underwriters to their best offer. That offer is the combination of price, terms, and conditions – not just price.

One quote at $45,000 with a $50,000 retention may not be better than a quote of $50,000 with a $10,000 retention. There are dozens of other factors that come into play, but that’s just one example.

What to expect moving forward

For the rest of 2023, we expect to continue seeing rates for D&O insurance continue to flatten out and dip further. As mentioned earlier, with fresh capital and players entering the management liability space the small and medium-sized market segment should continue to see rate relief in this area.

But (I know you hate sentences that start with but), there are grumblings in the market that claim frequency and severity costs are continuing to climb which will challenge insurers and their pricing strategy into 2024.

Here’s the bottom line.

Start your renewal process early

Work with a skilled D&O insurance professional who can bring resources to bear to make sure you’re getting the insurance program and the right policy.

Take premium savings to expand protection in areas not considered previously, such as dedicated A-Side protection, EPLI, or others.

If you’re considering any M&A Activity or an Initial Public Offering (IPO) this year prior to your renewal – speak to your broker about that as soon as possible as coverage terms are often affected by change-in-control and going public.

Gordon Coyle is The Coyle Group’s CEO and a seasoned business insurance expert with over 40 years of experience and four professional designations. He specializes in helping businesses with 25 to 1,000 employees navigate the complexities of risk and insurance, from cyber insurance to D&O protection and everything in between. Gordon is passionate about providing tailored solutions that protect businesses, their owners, and their futures.

Need guidance on your business insurance? Contact Gordon for help!