Our Story

The Coyle Group is a boutique insurance brokerage and risk

management solutions firm focused solely on the business

marketplace. Founded as Coyle & Coyle in 1929 by brothers

Harry & Jack Coyle in a small office in New City, NY the firm

was originally a real estate and insurance brokerage serving

the still very rural Rockland County. Today, we are exclusively

focused on business insurance and creative risk solutions for

business owners in the greater New York City Metro area and

beyond.

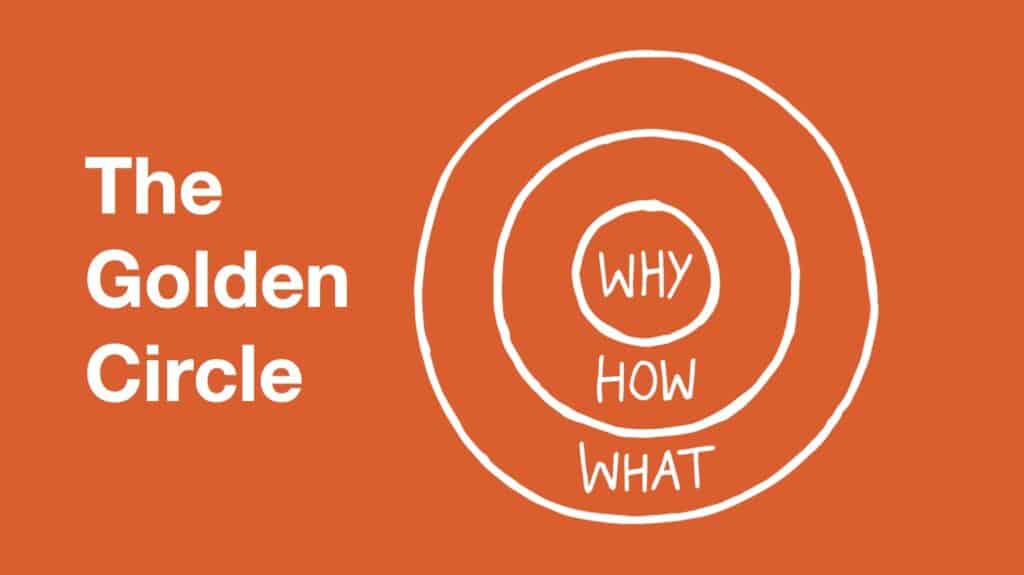

Our Why

Most business owners have much of their

personal net worth invested in their businesses.

The lowest price sales process deployed by most

insurance brokers puts the client, their livelihood,

and their net worth at risk. We take this

responsibility very seriously, and frankly the

commoditization of business insurance really

pissed us off. So we vowed to change that. It

became our WHY, and our reason for creating a

unique process which does more than shop the

marketplace for price.

Simon Sink’s Golden Circle shown above is the

principal behind every successful business and a

powerful model for driving results.

Meet The Team

Gordon B. Coyle,

CEO, CPCU, ARM, AMIM, PWCA

Karen Coyle

VP of Operations

Rafe Ruggiero

Marketing & Placement Specialist

Claire McGranaghan

Senior Account Manager

Donna Richard

Senior Account Manager

Recent case studies & results

When is a good time to have a review of my insurance performed?

Insurance reviews are NOT a quoting exercise, but instead are a thorough analysis of the coverage terms and conditions you have compared to the risks you face. A review should provide you insight into how well your insurance policies are structured and coordinated. A good time to have a review performed is just about any time during the policy term. The best time is going to be about 3 or 4 months before your expiration/renewal so you evaluate making the changes needed and price them into your renewal program.

How can The Coyle Group help my business manage its risks?

For us, the process of managing risk starts with risk identification, and this is done through the evaluation of your loss history, a physical inspection of your premises or job sites, OSHA reports and conversations with leaders within you firm. Once we have identified the risks your business faces and the priority of those risks we can design a plan tailored to your specific needs. This can include safety documentation and communications, training, safety culture awareness, fleet management, OSHA compliance, and more.

What are loss runs?

Loss runs are reports generated by your insurance companies that provide details as to the claims your company has incurred over a specific time frame; typically 3 to 5 years. Loss runs are needed in most cases for an insurance broker to quote your account because insurance company underwriters will price your account based on your specific loss history.

Have fewer claims than your peers and you’ll likely pay less for insurance. Have a greater number of claims or payouts and you’ll pay more than your peers for insurance.

What’s a BOP policy?

BOP stands for Business Owners Policy and it was created in the mid 1980s to help simplify business insurance for small businesses. A BOP often will include at least two coverage parts: property coverage and liability coverage. In addition to those core coverage parts a BOP policy will automatically include dozens of “fringe” coverages needed by most businesses and the ability to add other coverage parts like umbrella to one policy, and billed on one bill.

Is it difficult to switch insurance agents or companies?

No, for the most part if you decide you to switch agents and or insurance companies the process is pretty simple. It is advisable in most cases to make a change on the renewal date to avoid what is known as a “short-rate cancellation” penalty. Also, switching on a renewal date is cleaner and easier for everyone involved.

If I buy direct from an insurer and cut out the agent, do I save money?

When it comes to commercial insurance there are “direct insurers” where you can buy insurance and they claim that going direct will save you money. But the simple fact is that someone has to service your account, answer questions, issue certificates of insurance, handle changes, and give you advice. Whether that’s an agent or an employee there’s a cost to it, so it’s hard to say which is less expensive. But what we believe is that business insurance is not a “do it yourself” type experience and having an expert guide you on the right types of insurance and limits to purchase is valuable.

Also, when you buy direct, you’re dealing with an employee of the insurance company – who is their allegiance to? Their employer. In addition you can only buy the products that company sells. What happens when you need a product they don’t sell?

When you buy from an independent agent or broker you are getting a much broader representation to the insurance marketplace and you’re working with an entrepreneur, like you, who is focused on helping you make the most informed decisions. Price/cost is important when it comes to insurance, but we think buyers should be thinking about value and who is going to give them the most value for their premium dollars.

Why do insurance agents need so much info to quote my policy?

This is a great question, because when you’re buying insurance it may seem like there are endless questions and applications; especially if you’re looking for forms of insurance like D&O, Cyber, Employment Practice Liability Insurance and others. The basic reason we need to collect so much info is because underwriters need much of that info to make decision on whether to issue a quote to you, and for determining the price of that quote.

For most small business BOP type quotes we typically don’t need a lot of info to get the process started to offer you a proposal.

What are some ways to keep insurance costs down?

Business Insurance premiums are driven by a few factors – the state of the marketplace, your claim history, your company’s safety culture and its ability to control risk. For larger firms these factors will weigh more heavily in the pricing of your insurance than for smaller firms. Regardless of the size of your company or your insurance spend, the more control you have over risk, the less claims you will have, and this helps reduce insurance costs. Need help in controlling risk? Ask us! We have tons of resources and expertise to help you in this area.

How do I know if my business insurance coverages are adequate?

Data breaches are quickly becoming the most expensive type of claim a business can incur. If you have data, than you’re at risk. Protecting your data from external hackers as well as from internal mistakes made by employees is critical to protecting the “crown jewels” of your business. Preventing a breach includes the right mix of: 1. hardware such as firewalls; 2. software which is updated as well as intrusion detection, virus protection programs, and lastly 3. Training, the most often overlooked prevention strategy. On-going training of your employees is critical to prevent accidental clicking of malicious links, falling prey to phishing schemes, failing to follow protocols when wiring money, and more. For more help on cyber protection training, please contact us!

How do I prevent a data breach in my business?

No, for the most part if you decide you to switch agents and or insurance companies the process is pretty simple. It is advisable in most cases to make a change on the renewal date to avoid what is known as a “short-rate cancellation” penalty. Also, switching on a renewal date is cleaner and easier for everyone involved.

What types of businesses does The Coyle Group insure?

The Coyle Group works with a wide variety of businesses in just about every industry vertical. Manufacturers, wholesale distributors, retailers, professional service firms, financial service firms, technology companies, contractors, real estate investors, and more. Don’t see your business type listed? No worries, there’s too many to list, just give us a call and let’s chat to see if we’re a good fit for your business.