Management Liability and Directors and Officers Insurance

Directors & Officers Liability D&O, or Management Liability Insurance, is a broad term to describe a suite of insurance policies dedicated to protecting the management and leadership of a firm. D&O, EPLI, Fiduciary, Employed Lawyers, Crime insurance, and Kidnap, Ransom & Extortion Insurance often fall into the management liability insurance bucket.

Before describing each form of coverage, there are two key points to touch.

- The first is that many business owners think that only large public companies need these types of policies, which of course is false. Small business owners can be sued or investigated for the types of allegations which fall under this type of insurance, and those suits are very expensive and time consuming to defend against.

- These specialized forms of business insurance are specifically designed to respond to claims which they are built for. Meaning Employment Practice Liability Insurance covers you and your firm for claims alleging wrongful employment acts such as discrimination, harassment, etc. No other business insurance policy will protect you from that type of claim. Check out the videos below for more information.

The bottom line you may not need every type of Management Liability policy, but you likely will need some of these coverage forms. Without some of these coverages, your business and your leaders could face financial ruin when an allegation of wrongdoing arises.

There are six major Management Liability Policy Types,

which we explain in these videos.

Directors & Officers (D&O)

Employed Lawyers Coverage

Employment Practices Liability insurance (EPLI)

Crime Insurance

Fiduciary Liability Insurance

Kidnap, Ransom & Extortion (KR&E)

Want to learn more?

Top 5 Reasons to Purchase Directors & Officers Liability or D&O Insurance

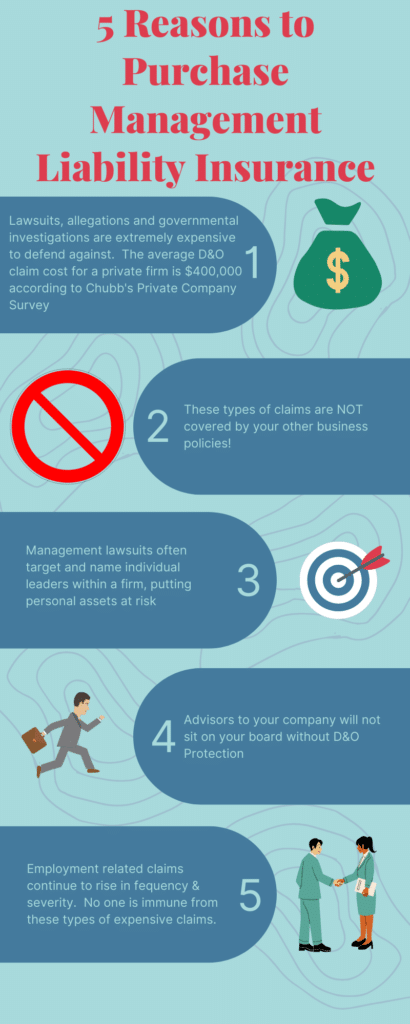

- Lawsuits, allegations, and governmental investigations which arise from owning and managing a company, large or small, can be extremely expensive to defend against. The average D&O claim costs private companies around $400,000 to settle according to Chubb’s Private Company Risk Survey. Moreover, the frequency of these types of claims continue to grow. In the same Chubb study, one in four private companies surveyed had experienced a management liability related loss in the past 3 years!

- These types of claims are not covered by your other business insurance policies. General Liability and Umbrella Liability protect your company from claims alleging bodily injury, property damage and personal injury. Management Liability claims often allege a wrong doing by an owner, director, manager, company officer, or an employee which caused a financial harm to someone else. Things like breach of duty, failure to comply with workplace laws, fraud, misrepresentation, harassment, discrimination, etc.

- Management liability related lawsuits commonly name the owner, director, officer, manager or other employees PERSONALLY for their acts. That means you as a company owner or leader are putting your personal assets at risk, and the fact that no other business insurance policy will respond to a claim of this nature means you’re paying out of pocket if the company can’t or won’t come to your defense.

- Most advisors and other leaders will not sit on your company’s board of advisors or directors without this protection. You need Management Liability to attract talent.

- Employment related claims continue to rise in frequency and severity. No one is immune from these types of expensive claims. Not only are they emotionally draining to defend against they can deplete a company’s treasury quickly.

What types of businesses need Directors & Officers Liability D&O or

Management Liability Insurance?

- Non-Profits – this not only includes traditional not for profits such as local organizations, but also boards you may sit on, such as a Homeowners Association. Yes, non-profits and their directors get sued, and they are sued often.

- Startups – especially those which are funded. Why? Because startups often will make statements regarding future growth, promises to investors, and when these “promises” don’t materialize, investors can and will sue founders and board members for breach of duty, etc.

- Venture-Backed Companies – If your company is lucky enough to grow to the point to get VC backing, you’ll almost certainly be required to purchase D&O Insurance. Obtaining protection before this funding round will help build credibility in the eyes of investors and make future rounds smoother.

- Privately Held Small Businesses – many entrepreneurs think D&O or EPLI and other forms of Management Liability Insurance is just for big public type companies. Nothing could be further from the truth. Not all small businesses need Management, but many do, and investigating your risk factors makes sense to protect the personal assets of company leaders.

- Near-IPO Companies – Getting the right Management Liability policy early that can be customized to include Road-Show protection and IPO protection is critical.

- Finserv – Financial Service Firms need not only Management Liability but its close cousin Professional Liability or E&O Insurance. Often these two policy forms are combined into one policy to protect the management and professional liability exposures of financial service firms like hedge funds, venture capital, private equity, private funds, RIAs, and more.

- Technology Firms are often high-growth firms that move quickly and look to attract outside capital, therefore making them targets for D&O lawsuits. Managing that risk makes Management Liability a key purchase decision.

Want to learn more?

EPLI Insurance – what is it and why you need it?

EPLI or Employment Practice Liability Insurance is an important coverage part within a Management Liability portfolio to protect the owners, managers and leaders of a company from claims alleging wrongful employment acts. This video explains what this coverage form is and why you need it.

What does Directors & Officers Liability D&O Insurance Cover?

D&O Insurance is an often-misunderstood form of business insurance. What is covered, why do you need it, how does it work, and more are the questions I’m often asked. In its most basic sense, D&O or Directors & Officers Liability Insurance protects your company’s decision-makers from claims which can arise from “wrongful acts”. You can think about it like malpractice coverage for decision-making by owners, leaders, managers, directors, and officers. In this video, I describe it in more detail and how this unique coverage protects the personal assets of your firm’s leaders.

D&O Insurance Glossary

If you’re shopping for D&O Insurance or already have a policy, you probably know that this line of coverage has its own unique coverage forms and language. There are tons of coverage terms and words you don’t commonly see in other business policies, which is why we have this D&O Glossary to give you some detail as to key terms and concepts when it comes to D&O Insurance. As always, if you have a question, let’s chat!

What does D&O insurance cost and how do you get it?

There are a variety of factors that go into the pricing of D&O Insurance. Your industry, revenue size, headcount, financial stability, and more. Startups and higher-risk industries such as biotech often see premiums on the higher side of the range (based on size) due to the frequency of claims that occur in this space. Mature firms in traditional industries see premiums on the lower side of the premium ranges I mention in this video.

To get the best pricing, it makes sense to work with a broker experienced in this coverage area who has broad market access and can provide you guidance and expertise, like The Coyle Group

Why get Directors & Officers Liability D&O from The Coyle Group?

If you’ve never been down this road before, or you’re looking for options on your management renewal, you may be asking: Where can I get the best deal? Who can I trust? How will I know I’m getting what I need? Here are the reasons you should consider The Coyle Group:

The first is expertise. Over the last 30 years, we’ve developed deep domain expertise working with small and medium-sized firms on management liability insurance. We can take complex issues and break them down into understandable concepts to help you make a more informed buying decision.

We also have unparalleled access to the global management liability marketplace and leave no stone unturned to find you the right coverage at the right price, even for the most difficult-to-place accounts.

Finally, we’ve made the process easier and have automated the application process from the beginning and on each renewal. On top of that, we believe in the value of relationships and have experienced dedicated account managers you’ll be paired with to help you along the way and be your “go-to” person for support once you become a client. No call centers, no massive phone trees, no time wasting.

Want to learn more?

Read More about Directors & Officers Liability

(D&O) / Management Liability

What Does Equipment Breakdown Insurance Cover? – Why Manufacturers Need Breakdown Coverage

What is Equipment Breakdown Insurance? Equipment breakdown, mechanical breakdown and boiler and machinery…

Do You Need Insurance if You Have an LLC?

I’ve heard some startups question whether they need business insurance because they have…

What is Road Show Coverage?

Road-Show Coverage in a D&O Policy. What is it and who needs it?…

5 Types of Insurance for an Importer

You’re importing goods from overseas and you’re not sure what type of business…

Non-Profit D&O Insurance – Protecting Your Board Members

Non-Profit D&O Insurance or Directors & Officers Liability Insurance. What is it, why…

Food Manufacturing Product Recall

What would happen if you, as a food manufacturer learned that the product…

EPLI Policy: When Should I file a claim

The other day an HR consultant asked me when should a client file…

What is Trade Credit Insurance?

Trade Credit insurance, export insurance, and accounts receivable insurance are all terms that…