If your line of business includes imported Chinese products from China and you’ve searched for liability insurance you may have experienced some difficulty and expense.

Why is that? In this video and post, we explain it.

Okay, so you’re importing imported products from China or some other foreign country and distributing them here in the US.

Your customers are demanding certificates of insurance and you’re having trouble finding an insurer to write your general liability insurance.

Why is that?

There are a couple of reasons.

The first reason is that manufacturers overseas often don’t carry liability insurance or product liability insurance, and even if they do it’s virtually impossible to collect on those policies.

Mostly because those policies aren’t going to cover claims that occur outside of their home country.

The reason this impacts you is that as a wholesale distributor, your insurance company wants to know that if a product liability claim occurs, they can subrogate or go after the manufacturer for any claims they pay out on.

The reasoning is that if the manufacturer made a faulty product that caused injury or damage to a customer, they – the manufacturer should be ultimately responsible for paying that claim.

When your goods are manufactured in China or another far east country and there’s no collectible insurance, so it’s going to make it difficult and expensive to get coverage for you.

If you distribute products made in US manufacturing facilities it’s typically not a problem to secure coverage because your insurer knows they can subrogate product claims against the manufacturer and may recover whatever dollars they pay out on in claims.

The second reason that product liability insurance for imported Chinese products is difficult to get or afford on goods coming from overseas is the lack of quality control over those products.

Even in circumstances where the importer has a QC department overseeing the products manufacturing process, the question of quality control comes up.

Many insurers are just not comfortable due to the historical bad news that often comes from foreign products where manufacturers use low-quality parts, may use harmful substances in the manufacturing process, or skimp on their own quality control.

These issues all add up to make getting insurance somewhat difficult.

So, what’s the answer?

While brand name insurers like Travelers, Chubb, Hartford, and many others will shy away from writing product liability insurance on goods imported from China and other countries, there are other insurers in what is known as the excess and surplus marketplace that will.

Yes, it’s a bit more expensive than goods made in the U.S., but that’s the cost of doing business.

We have a deep bench of insurers that write difficult products as well as imported products.

If you’ve got issues or problems here, we can help.

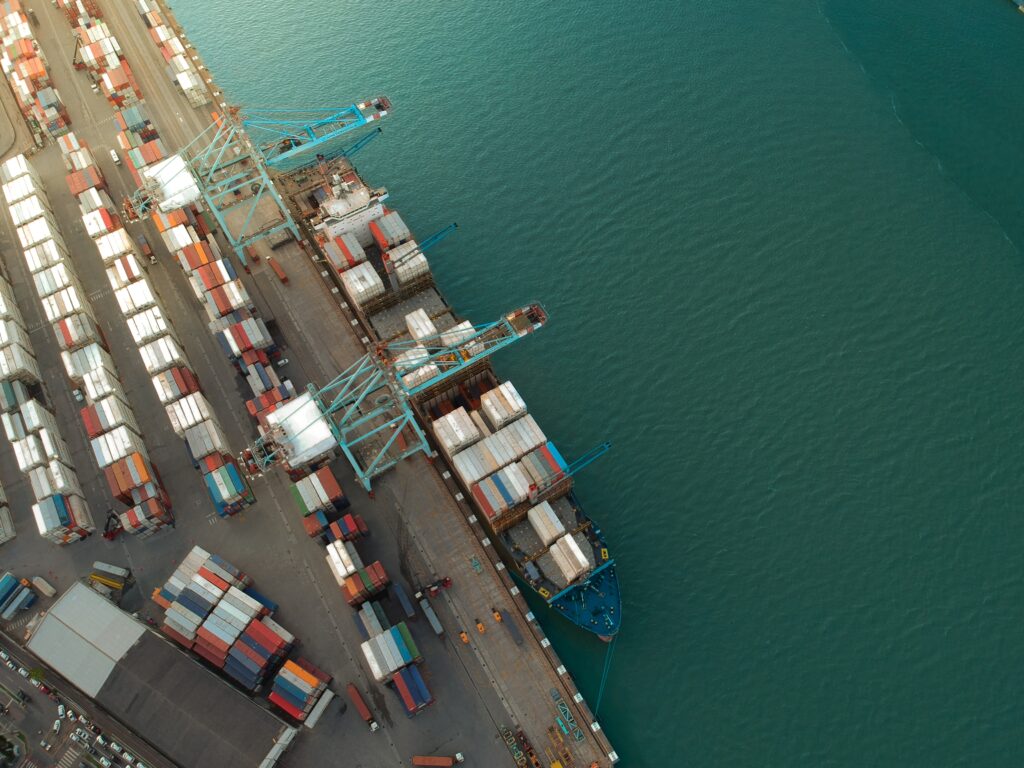

Also, when importing you’ve got to be thinking about insuring those goods as they make their way from the manufacturer to you – whether that’s by ocean cargo, or air and then moved from the docks to your warehouse distribution centers.

We excel at cargo insurance and would love to work with you on that and other insurance issues you’re facing.

You can contact me by email or phone – so let’s connect and see how we can help you.

Thanks!