Are you a business owner struggling to control commercial auto claims?

Or, are you concerned that auto-related crashes could end up hurting your business and create potential liabilities for you?

If you answered yes to either of those questions, I’ve got some help, coming right up

Hey, thanks for watching or reading. So, commercial auto insurance claims. A weighty subject.

Not only do business auto and truck insurance claims create higher insurance rates, but they also have the potential for loss of life and serious injuries for your employees and others. But they also carry the potential for significant liability risks, lost time, decreased productivity, and of course an impact on your company’s bottom line.

In my experience, there are two major areas to focus on – hiring practices and risk control practices.

I’ll mention some resources below, but I do recommend speaking to your business insurance broker for assistance here as they should be able to help you with a risk control strategy. If your agent can’t come up with a strategy to help you with business auto insurance solutions, you may have outgrown them, and you may want to find a new agent.

So, the first area I want to discuss is hiring the right drivers and continuing to monitor the drivers you have through a qualification process.

Yes, I know that recruiting and hiring right now is next to impossible but lowering your standards to fill positions just isn’t a good idea.

So, how do you set up and maintain driver standards?

It starts with reviewing MVRs for all potential hires as well existing employees.

We recommend that at minimum for existing employees that reviews are conducted annually, but depending on circumstances, we have seen some employers conduct MVR reviews on all employees quarterly.

In fact, there are services in some states which monitor MVRs continually, and when an incident occurs the employer is notified of a ticket, violation, or accident.

While the MVR provides a historical report of what has happened, it often can be a predictor of what may happen in the future. Drivers with poor records seem to continue to exhibit poor driving habits in my experience.

Here are some of the qualification standards we recommend for potential hires:

- No serious moving violations in the past five years. This includes DUIs, hit and runs, reckless driving, driving with a suspended license or excessive speeding.

- Fewer than three moving violations in the past three years

- Fewer than two at-fault accidents in the past three years.

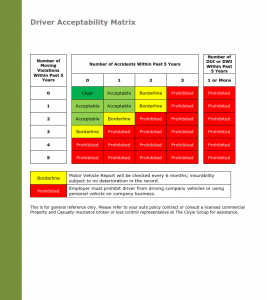

I have a driver qualification matrix that can be used for your business and it’s found below. Feel free to download it and use it, as the qualifications I mentioned above are interrelated to each other, and this matrix will help provide a baseline qualification. It will also help demonstrate to your insurer that you’re serious about risk control.

The second major area to focus on is increasing risk control awareness and enforcement, and here are some major ideas for you to consider:

- Mandate seat belt usage

Wearing a seat belt at all times can reduce the risk of injury or death in an auto crash by as much as 50%. Yet, it’s not always a safety rule followed by all drivers. You can create a successful seat belt policy by;

- Incorporating seat belt awareness into your driver safety enforcement program. If you’re serious about reducing crashes then a leader within your company must lead a program like this and regularly rally the troops around safety.

- The second thing I recommend is asking employees to sign a pledge saying they will wear a seat belt at all times. It may seem trivial, but asking an employee to sign a pledge is a sign of commitment.

- Minimize driver distractions

Distracted drivers increase the risk of crashing while texting or using a cellphone by a factor of 2 to 6 times higher than a driver who is not distracted. The National Safety Council indicates that over 700 people per day are injured in distracted driving crashes.

To avoid distractions:

- Consider banning all cellphone use, even if it’s legal in your state or if hands-free is used.

- Asking drivers to sign a distracted driving pledge – this helps bring awareness to the problem and creates commitment as I mentioned with seat belts.

We have a very comprehensive Distracted Driving Prevention program guide available for you to download. Which is also found below. Download it, review it, and see how you can incorporate it into your organization.

- Utilize technology

- In-vehicle telematics has become more and more affordable. In fact, some systems use the driver’s smartphone instead of a separate device to record motions and accidents.

- What telematics does is record in real-time hard braking, fast acceleration, swerving, and sudden stops such as in an accident. It reports these actions back to a dashboard or central program used by a fleet manager or business owner to be aware of what’s going on, on the roads by their drivers so they can take corrective actions with drivers. Many devices will record inside and outside the vehicle if an accident is suspected which can be used as supporting evidence if litigation ensues following an accident.

- Before installing telematics or dashcams, be sure to review privacy laws in your jurisdiction with regard to videotaping.

- Driver training.

Drivers are of course the key to successfully preventing accidents. The types of issues to be covered in training include:

- Zero tolerance policy on intoxicants

- Defensive driving, safe driving habits.

- Preventing drowsy driving which is the cause of about 91,000 crashes every year.

- Seasonal hazard awareness. Everything from being aware of pedestrians and cyclists during warm months, to snow/ice hazards during the winter months.

That’s just a brief overview of the issues you should be thinking about to reduce or eliminate the risks of auto claims in your business. If you’d like some specific information or guidance on preventing or reducing auto claims and crashes in your business, give me a call or drop me an email and let’s start a conversation. Just click the button below to get started.

Thanks!