Selecting The Best Workers Comp Policy in New York,

may seem like going to the paint store and selecting the right color paint for your next painting project. So many choices, and not a lot of directions on which is the best.

In New York, there are a variety of issues that determine how to go about selecting the right workers comp policy. Let’s start with a broad overview of the subject.

- For most small businesses that are spending under $10,000 a year for insurance, the insurer you use for your business owners policy is probably the most logical choice for your workers compensation. For small retailers and office exposures, the workers comp premium isn’t that large so by combining your policies you may gain some credits on your account, but more importantly everything is with the same insurer so it’s easier to handle for you, including the billing.

- For small to medium-sized contractors in NY, you, unfortunately, don’t have a lot of choices. There are some insurers that will write lower hazard contractors for workers compensation, but most higher hazard (height-related) contractors are going to end up in the State Insurance Fund. Sorry to say.

- For larger employers, those with more than 50 to 500 employees the best workers compensation policy is going to depend on a lot of factors. Things like your loss experience, how well you manage risk, your experience rating modifier, and the hazards of the classes on your policy. There isn’t going to be one insurance company that is going to be the best or “right one” until some underwriting takes place to determine where you’ll best fit.

One thing you should know about workers compensation in New York is how rates are developed.

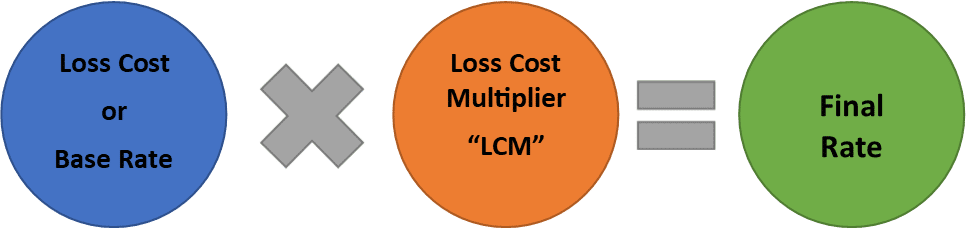

For every classification code, The New York State Compensation Insurance Rating Board establishes a base rate which is called a “loss cost”. This rate is used by all insurers in the state in their rate development and is the baseline or starting point. Each insurer then applies what is known as a loss cost multiplier to that base loss cost to arrive at a final rate. Most large insurers such as Travelers, The Hartford, or Chubb will file with the State Department of Financial Services multiple loss cost multipliers (commonly referred to as LCMs).

At the time of this writing, the lowest LCM is 1.050 and the highest is 1.68 – that 63 point spread means that there’s a lot of pricing tracks and flexibility among the different underwriting tiers filed by insurers in New York.

Here is a diagram of what the rating methodology looks like:

The lowest LCMs are typically reserved for clients in very low hazard classes and with very good loss experience; while higher LCMs are in place to accommodate higher hazard firms or firms with higher loss experience. It only makes sense that a firm with average loss experience is going to score an average LCM and a firm with a great loss history – meaning no claims or few claims will score a very low LCM.

So getting back to how to selecting the best workers comp policy, a lot of it going to depend on your underwriting characteristics and what you’ll expect from your insurer. If you’re a larger firm, good support from the insurer’s risk control department may be important for you to help manage risk. If you want a pay-as-you-go type policy that will track your premiums to your actual payroll each week or month, then you’ll need to find an insurer that offers this type of plan.

In my opinion, it really comes down to the broker selection rather than the insurance company selection that’s going to make a difference for you. Especially if your premiums are over $50,000 a year. Larger firms that purchase workers compensation through market competition or a shopping exercise and then select the lowest proposal, may be doing themselves a disservice. Most good brokers, including The Coyle Group, represent a wide variety of companies so having one broker control the shopping process for you is to your advantage. The other thing to look for is what services or expertise is the broker going to add to the equation? Does the broker have a particular expertise when it comes to workers compensation and worker injuries? Have they solved a problem for other clients in the past? Do they provide more than just a policy? Will they be there to help you and your team perform to its safest level possible?

These are questions you should be asking when searching for a new or selecting best workers comp policy and will help answer the question on how to select the right workers compensation policy. Often it’s not the policy, but the broker that’s going to make the biggest difference for you.

The bottom line is that The Coyle Group is uniquely qualified to work with New York employers who have challenges with workers compensation or feel that they’re overpaying for workers compensation. We have deep domain expertise in comp and have created unique customized solutions for clients in a variety of industries that have resulted in lower claims, lower premiums, and greater productivity.

To learn more, click the button below, and let’s set up some time for a chat.